Figure out paycheck

Get Started With ADP Payroll. Hourly Salary - SmartAsset SmartAssets hourly and salary paycheck calculator shows your income after federal state and local taxes.

Paycheck Calculator Online For Per Pay Period Create W 4

Calculate your state local and federal taxes with our free payroll income tax calculator simply choose your state and you are all set.

. This number is the gross pay per pay period. Ad Create professional looking paystubs. Subtract any deductions and.

Ad Compare This Years Top 5 Free Payroll Software. We use the most recent and accurate information. Need help calculating paychecks.

Theres 12 people making 50hour at the head office so I know the hourly pay cant be higher than everyone but the CEO. Ad Simply the best payroll software for small business. Ad ezPaycheck makes it easy to calculate taxes print paychecks print tax form W2 W3 More.

It can also be used to help fill. Heres a step-by-step guide to walk you through. In a few easy steps you can create your own paystubs and have them sent to your email.

Stop paying fees each time you process. Total annual income Tax liability. Free Unbiased Reviews Top Picks.

Free Unbiased Reviews Top Picks. Compare and Find the Best Paycheck Software in the Industry. Employees pay 145 from their paychecks and employers are responsible for the remaining 145.

Enter your info to see your. Take-Home-Paycheck Calculator Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. Approve Hours Run Payroll in App.

Michigan Paycheck Calculator - SmartAsset SmartAssets Michigan paycheck calculator shows your hourly and salary income after federal state and local taxes. Important note on the salary paycheck calculator. Enter your info to see your.

Software That Fits Your Needs. Ad Payroll So Easy You Can Set It Up Run It Yourself. Process Payroll Faster Easier With ADP Payroll.

Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly. You will need your. If you earn wages in excess of 200000 single filers 250000 joint filers or.

To calculate your annual salary multiply the gross pay before taxes by the number of pay periods in the year. Hourly Paycheck and Payroll Calculator. Sign up run payroll fast.

This is tax withholding. Use this tool to estimate the federal income tax you want your employer to withhold from your paycheck. Get 3 Months Free Payroll.

Use PaycheckCitys free paycheck calculators gross-up and bonus and supplementary calculators withholding forms 401k savings and retirement calculator and other specialty. Calculate Business Payroll On The Go. The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and.

To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year. I dont think theres a native way to calculate the average of. To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year.

Ad Simplify Upgrade Enjoy Easy Payroll Tailored To Your Needs. A Paycheck Checkup can help you see if youre withholding the right amount of tax from your paycheck. See how your withholding affects your.

Designed for small businesses to make payroll Easier and simple. This number is the gross pay per pay period. The Salary Calculator converts salary amounts to their corresponding values based on payment frequency.

Ad Compare This Years Top 5 Free Payroll Software. Subtract any deductions and. For example if you earn 2000week your annual income is calculated by.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Enter your info to see your take home pay. This free paycheck calculator makes it easy for you to calculate pay for all your workers including hourly wage earners and salaried employees.

Taxes Paid Filed - 100 Guarantee. Too little could mean an unexpected tax bill or penalty. Ad Calculate Your Payroll With ADP Payroll.

Customized for Small Biz Calculate Tax Print check W2 W3 940 941. SmartAssets Pennsylvania paycheck calculator shows your hourly and salary income after federal state and local taxes. Examples of payment frequencies include biweekly semi-monthly or monthly.

Once you have worked out your tax liability you minus the money you put aside for tax withholdings every year if there is any. Ad Run Easy Effortless Payroll in Minutes.

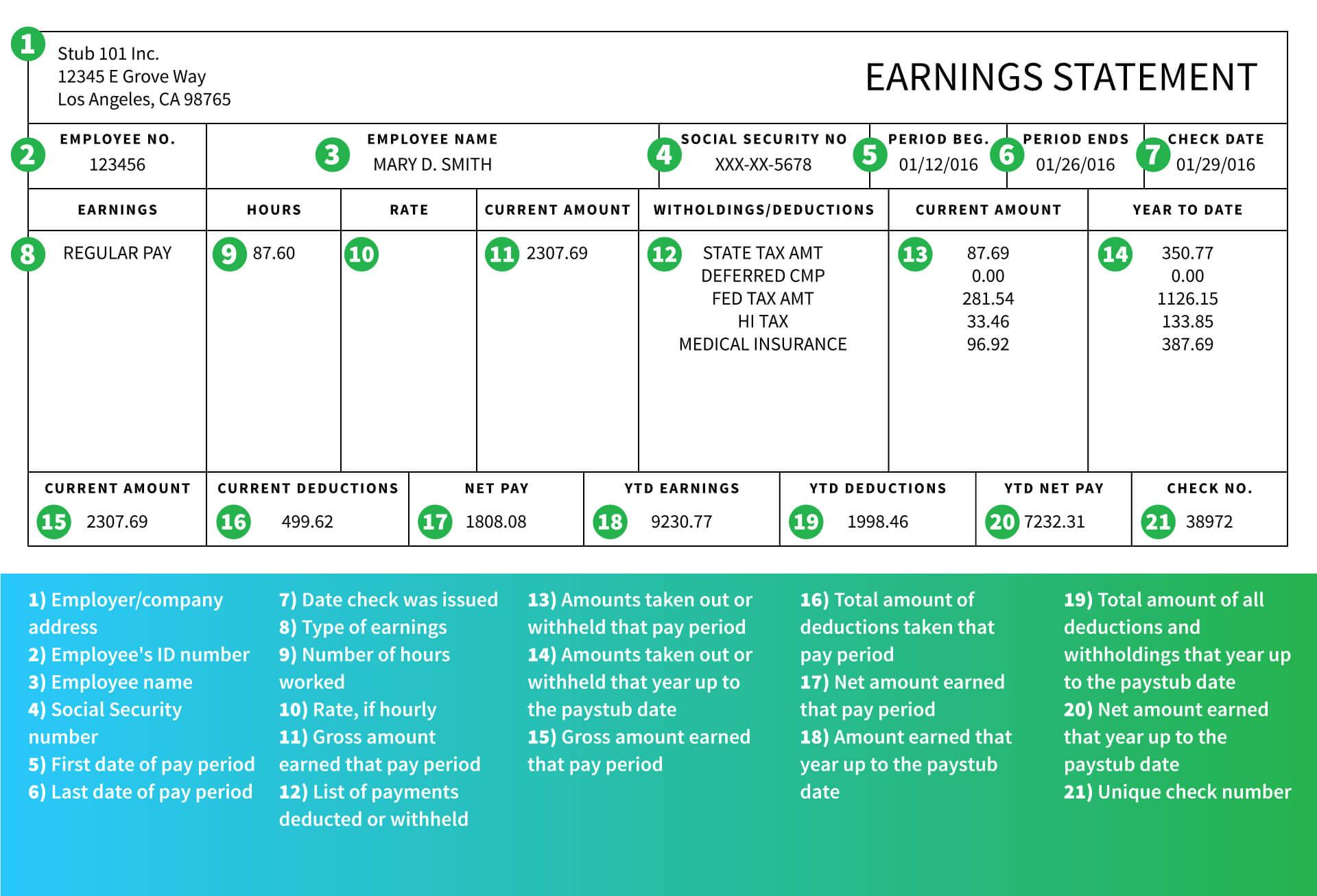

Understanding Your Paycheck

Paycheck Calculator For Excel Paycheck Payroll Taxes Consumer Math

Paycheck Calculator Take Home Pay Calculator

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Hourly Paycheck Calculator Step By Step With Examples

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

Free Paycheck Calculator Hourly Salary Usa Dremployee

Gross Pay And Net Pay What S The Difference Paycheckcity

Gross Pay And Net Pay What S The Difference Paycheckcity

How To Read A Pay Stub Gobankingrates

Paycheck Taxes Federal State Local Withholding H R Block

How To Calculate 2020 Federal Income Withhold Manually With 2019 And Earlier W4 Form

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

How To Calculate Monthly Income From Biweekly Paycheck Hassle Free Savings

Adp Salary Paycheck Calculator Outlet 58 Off Www Ingeniovirtual Com

How To Create A Paycheck For A Salaried Employee Paid 9 Months A Year

Paycheck Calculator Take Home Pay Calculator