1099 unemployment tax calculator

Give your employees and contractors W-2 and 1099 forms so they can do their taxes The calculator above. Forms you receive When.

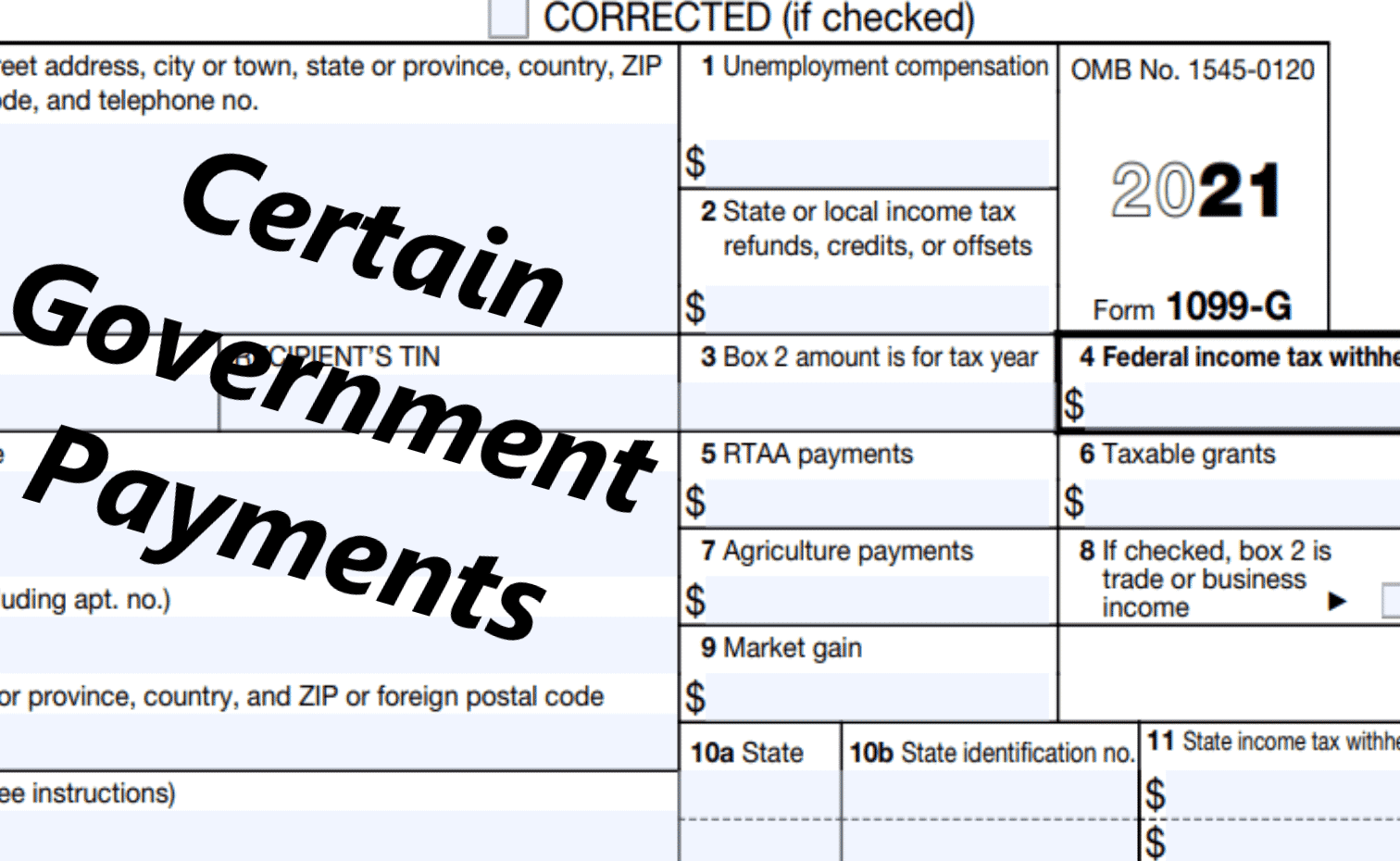

1099 G Unemployment Compensation 1099g

Unemployment income Tax calculator help.

. Online initial claims and other benefit information pages are now available in Spanish. Before we jump to your questions you may want to see how your unemployment income will affect your taxes. Here is how to calculate your quarterly taxes.

How to calculate your tax refund. Use the IRSs Form 1040-ES as a worksheet to determine your. Calculate taxes youll need to withhold and additional taxes youll owe.

This calculator provides an estimate of the Self-Employment tax Social Security and Medicare and does not include income tax on the profits that your business made and any other income. For the tax calculators below be sure to have your 1099 or W-2 form handy and be ready to answer a few basic questions about your filing status income. If you want taxes withheld from your weekly benefit payments you must tell us this when you file your claim.

To use the free self-employed tax calculator a self-employed individual needs to download and install FlyFins mobile app and spend 10-to-15 minutes to obtain a self. How Income Taxes Are Calculated. To determine the amount of Illinois self employment tax owed you need to determine your annual earnings.

Select the Español link to access the Spanish version. Pay FUTA unemployment taxes. Your unemployment benefits are taxable.

Estimate Taxes For Independent Contractor Income Unemployment Benefits and IRS Payments. Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan. The Statement for Recipients of Certain Government Payments 1099-G tax forms are expected to be available in mid-January 2022 for New Yorkers who received.

Calculate your adjusted gross income from self-employment for the year. Select Get your 1099-G from My UI Home in the online claimant portal to access your 1099-G tax forms. Then you apply the Social Security 124 to a base amount.

To do this you may. Unemployment pay1099-G retirement pay 1099-R StateLocal Tax Rate. Box 1 of the 1099-G Form shows your total unemployment.

This Estimator Plans For 2024 And Will be Updated. Log on using your username and password. Free online income tax calculator to estimate US federal tax refund or owed amount for both salary earners and independent contractors.

Unemployment Benefits for Claimants.

Solved Turbo Tax Tells Me I Need To Enter A State Identification Number Form 1099 G Box 10b But My 1099 G Form Is Grayed Out And Does Not Provide Me With One What

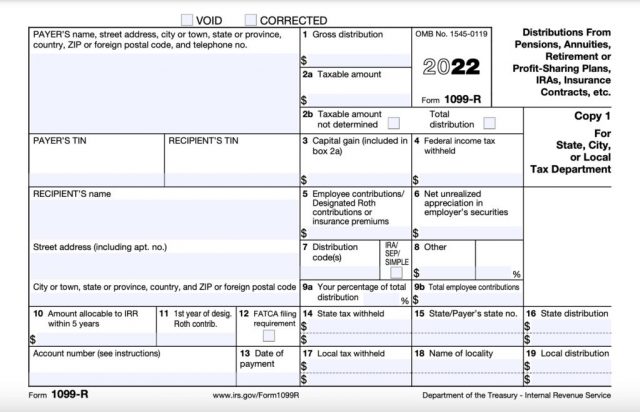

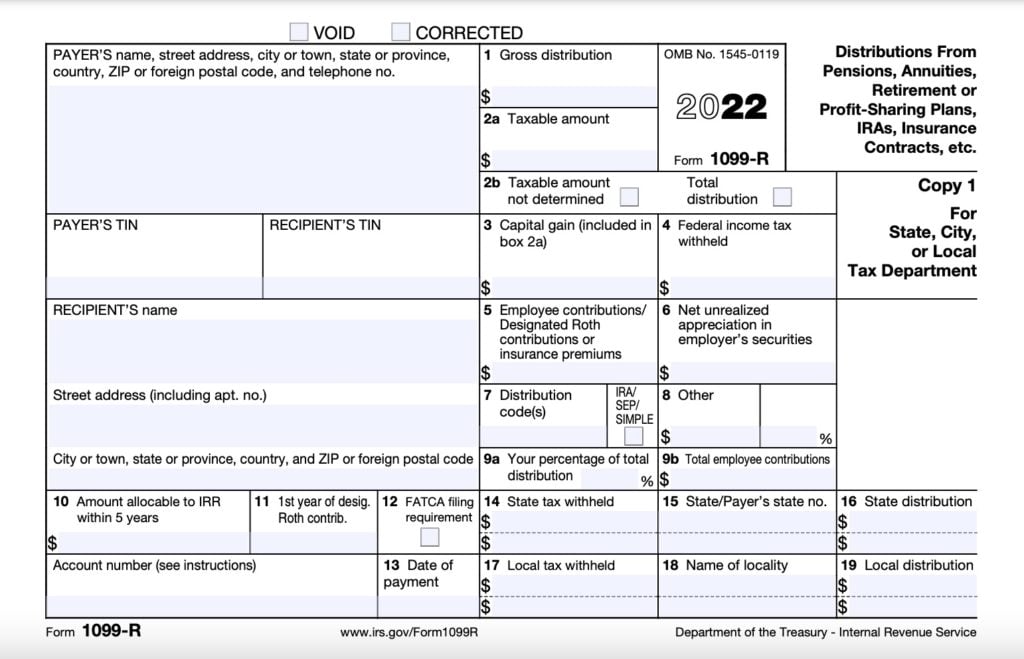

What Is A 1099 R Tax Forms For Annuities Pensions

Here Is The Difference Between The Form 1099 Nec And Form 1099 Misc Forbes Advisor

Doordash 1099 Taxes Your Guide To Forms Write Offs And More

:max_bytes(150000):strip_icc()/Form1099-INT2022-5e04b7fa54e54d2789d24757e86b1bff.jpg)

1099 Int Interest Income

What Is A 1099 R Tax Forms For Annuities Pensions

How Do Food Delivery Couriers Pay Taxes Get It Back

What S The Difference Between W 2 1099 And Corp To Corp Workers

Form 1099 Nec For Nonemployee Compensation H R Block

How Do Food Delivery Couriers Pay Taxes Get It Back

/1099-MISC-88cdf3af79f3437ea04b0666287c08a1.jpg)

Form 1099 Misc Miscellaneous Income Definition

:max_bytes(150000):strip_icc()/1099-Rpdf1-b1fa4454f3af489aa717304e4667e415.jpg)

What Is A 1099 R

1099 G Form 2021

1099 G 1099 Ints Now Available Virginia Tax

This Annual Tax Reference Guide Is For Any Business That Has Employees And Contractor Bookkeeping Business Small Business Accounting Small Business Bookkeeping

/1099-MISC-88cdf3af79f3437ea04b0666287c08a1.jpg)

Form 1099 Misc Miscellaneous Income Definition

If You Don T Get Form 1099 Is It Taxable Will Irs Know Hint If A Tree Falls In The Forest